Short to Medium-Term Investment: Typically 1 to 3 years.

High Coupon: Versus comparable fixed income products of the same credit rating and maturity.Low Minimum Investment: $1000 minimum initial purchase $1000 increments thereafter.Knowledgeable concerning how options work and comfortable with investing in securities incorporating options.Seeking to diversify their investment portfolio.Willing to risk some or all of their principal investment.Looking for enhanced yield opportunities versus traditional fixed income.It is important to note that potential returns are limited to the coupon amount and the investor will not participate in the gains of the reference asset. However, the reference asset must close at or above a pre-determined level on the scheduled observation date in order for the AutoCallable Note to be called and pay the coupon. The coupon is typically structured so that it doubles on each observation date (“auto-call date”), so that if the coupon is X% on the first date, the coupon is two times X% on the second date and so on, all the way up to maturity. The auto-call note is created to offer a coupon that is higher than that of a fixed income bond with a comparable credit rating and maturity.

At maturity, if the underlying is below the barrier and the note has not been auto-called on any of the observation dates, the investor is fully exposed to the decline of the underlying versus its initial level. The downside barrier risk can be observed daily at the close of business, as in the case of discrete monitoring, or one time at maturity, as in the case of European-style monitoring. Principal ProtectionĪuto-call products offer a contingent downside protection feature that fully protects the investor’s initial investment as long as the underlying has not traded at or below the downside barrier. The underlying reference asset can be an equity, an equity index, a commodity, a commodity index, or a foreign currency. The product can only mature on one of these “auto-call” dates. The auto-call test is carried out on a set schedule of predetermined observation dates, typically Quarterly, Semi-Annually, or Annually.

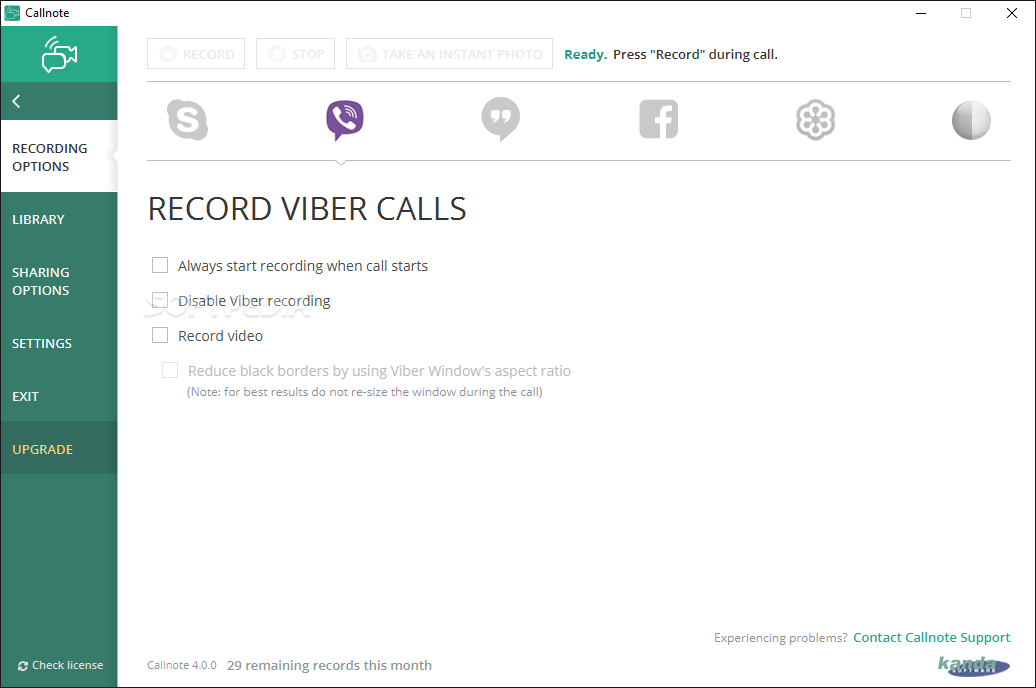

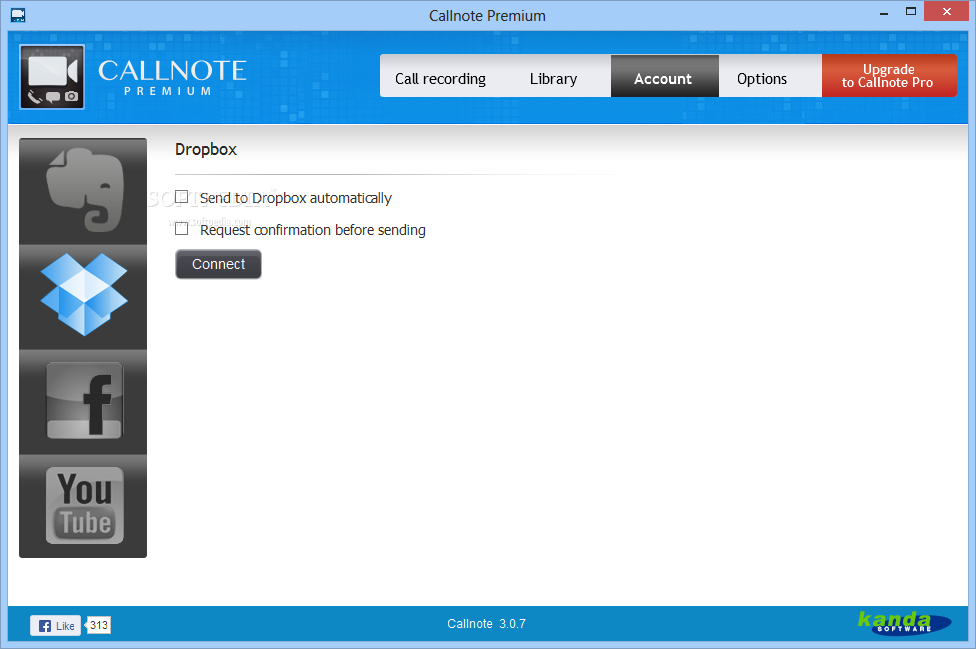

#Signup for callnote plus#

If called, the investor will receive their initial principal investment plus an above-market coupon. The product is automatically matured (“auto-called”) if the reference asset is at or above its initial level on a predetermined observation date. AutoCallable Notes are short-term market-linked investments offering an above-market coupon if automatically matured prior to the scheduled maturity date.

0 kommentar(er)

0 kommentar(er)